We have instant online homeowners insurance quotes for NC residents. Read below for more details on your specific area.

North Carolina has a population of 9.9 million. This state borders South Carolina, Georgia, Tennessee, Virginia, and the Atlantic Ocean. There are 100 counties in the state. Nicknames for North Carolina are Tar Heel State and the Old North State.

There are three different types of landforms here in NC. The coastal plain land is flat, sloping, and extends to the Atlantic Ocean and the Gulf of Mexico. The Piedmont hilly land that borders the Coastal Plain. Furthermore, the Appalachian Mountains are the enormous mountains in the eastern US. These mountains cover the ground from Canada to northern Alabama. North Carolina also provides 300 miles of sandy beaches.

The cost of living in North Carolina is also a plus factor. The price to live here is below the national average. In addition, this state provides the second largest state-maintained highway system. North Carolina is also the leading sweet potato grower in the US. In addition, it is the country’s second-largest producer of Christmas trees. Homeowners insurance companies NC offers its citizens are listed below.

How much is homeowners insurance in NC?

In a recently conducted study, we compared North Carolina quotes for a 1,500-square-foot house. We gathered homeowners insurance quotes from five major insurance companies. The companies included were: State Farm, Progressive, Nationwide, and Liberty Mutual. Based on the sample house listed above, Progressive offered the cheapest average annual premium of $675.

Shoppers will find the best cities with the cheapest homeowners insurance rates in the western portions of the state. Finally, homeowners insurance NC residents can afford. The low cost of insuring homes in this area was $780, less than what it would cost in a typical North Carolina Home.

Avoiding the Most Expensive Rates

Shoppers will find NC’s most expensive homeowners insurance in certain parts of the state. Located along the state’s eastern coast were the most expensive rates for home coverage. The east coast of the state experiences extreme weather conditions. As a result, these conditions will increase the risk of damage to homes, resulting in the insurance company paying out more frequently for a claim. Due to the home insurance company paying out more regularly, the rates will be more expensive.

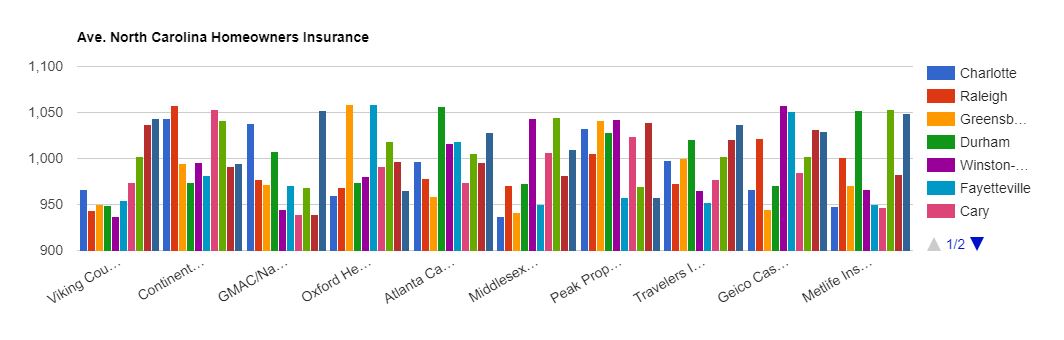

Average North Carolina Homeowners Insurance Quotes by City

Charlotte

Charlotte is North Carolina’s largest city. Therefore this city’s population is 792,800. Charlotte is home to the headquarters of the Bank of America and Wells Fargo operations on the east coast. Charlotte is known as the second largest banking center in the US. Charlotte’s nickname, “Queen City,” was given in honor of Charlotte of Mecklenburg-Strelitz. The best homeowners insurance in NC in this area will cost an estimated $950 annually.

Raleigh

Raleigh is North Carolina’s capital. This city is known as the “City of Oaks” because of its abundance of oak trees. Raleigh is also known as one of the fastest-growing cities in the country. This city is also home to the first state art museum in the country. In conclusion, the average cost of homeowners insurance here is $1,123.

Greensboro

The city of Greensboro received its name after General Nathanael Greene. Greene was a leader. He led American forces in a Revolutionary War Battle. Furthermore, this city is also home to Vicks VapRub. Lunsford Richardson developed this home remedy and many others under the name Vicks in this city. Greensboro rates consist of an average of $951.

Durham

This city is home to Duke University. In addition, Durham is also a part of the Research Triangle metropolitan region. Furthermore, this region consists of the towns Durham, Raleigh, and Chapel Hill. Research Triangle Park is home to the bar code. George Laurer founded the bar code.

Furthermore, Juicy Fruit gum was the first bar code item to be successfully scanned. In addition, this pack of gum is on display now at the Smithsonian museum. The average coverage premium here is $909 annually.

Winston-Salem

This city has a population of 236,440. Winston-Salem is also known as “Camel City” because they produced the popular camel cigarettes here. R.J Reynolds Tobacco Company made Camel Cigarettes. Moreover, Vernon Rudolph founded Krispy Kreme Doughnuts here as well. In addition, this city is also well known for its traditional furniture company. In addition, this city is one of the top cities to retire in. North Carolina homeowner insurance quotes in this city are, on average, $927.

Fayetteville

Fayette, North Carolina, is one of thirteen Fayetteville’s in the United States. Fayetteville is home to Fort Bragg. A central United States Army installation northwest of this city. This city is also home to the very first Golden Corral buffet chain. Golden Corral was initially known as the “Golden Corral Family Steak House.” The annual homeowners premium here is an estimated $1,349.

Cary

One of the safest major cities in the US is Cary. Therefore the city has a meager crime rate. The city of Charlotte has a crime rate eight times the rate of Cary. Within the last five years, Cary’s population grew by over 18,000. For coverage in Cary, the estimated annual premium is $1,025. While purchasing home insurance, NC residents need to remember their coverage needs. That way, they can be appropriately covered.

Wilmington

This city is also home to the historic Riverwalk. The Riverwalk of Wilmington is a wooden walkway that exceeds the borders of the Cape Fear River. Here you can see many landmarks and the heart of downtown Wilmington. The Riverwalk is open 24/7 and stretches for a mile. Wilmington is also home to the largest TV and movie facility outside of California. The average premium here for home insurance is $1,733.

High Point

This North Carolina city is well known for furniture manufacturing. The semi-annual High Point Furniture Market attracts thousands of exhibitors. Therefore, North Carolina homeowners insurance quotes cost you an estimated $940.

Asheville

Visitors will locate the city of Asheville in the heart of the Blue Ridge Mountains. This town is known for its art and historic architecture. The Downtown art district in Asheville has many galleries and museums. The River arts district is also home to artists’ studios. Homeowners insurance quotes NC residents collected show an average cost of homeowners insurance in Asheville is $859 annually.